Waterloo Region’s 2023 real estate market was slow for December across every segment, very much a repeat of the sales activity we saw in 2022. But prices have held up remarkably well in the face of the declines in volume we’ve seen over the last couple of years.

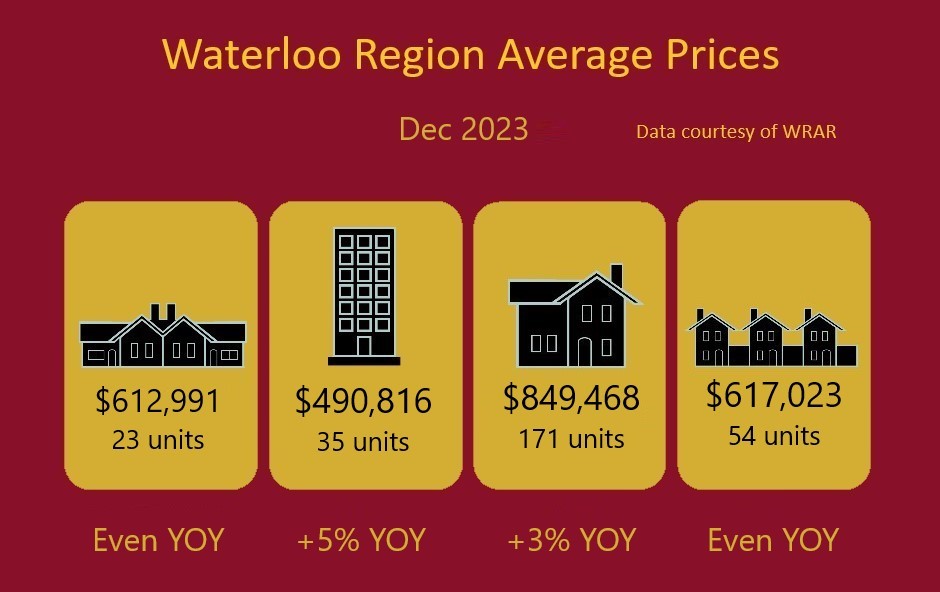

December Prices

Single Family Detached was the only segment down on a month over month (mom) basis, lower by $40,000 compared to November. Semis and Townhouses were flat mom, with Apt. Style Condos up sharply by 9%. Relative to last December prices for the month were flat for Semis and Towns and up moderately (by 3% and 5% respectively) for Detached and Apt. Style Condos.

Yearly Prices

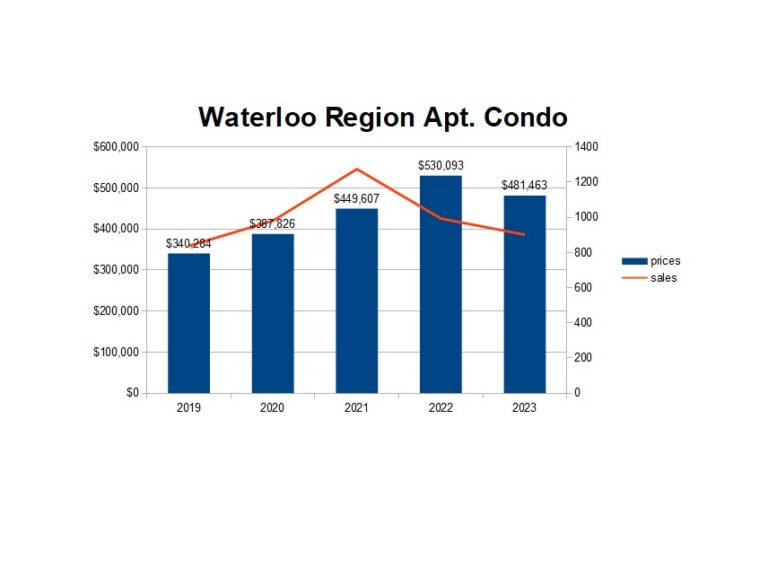

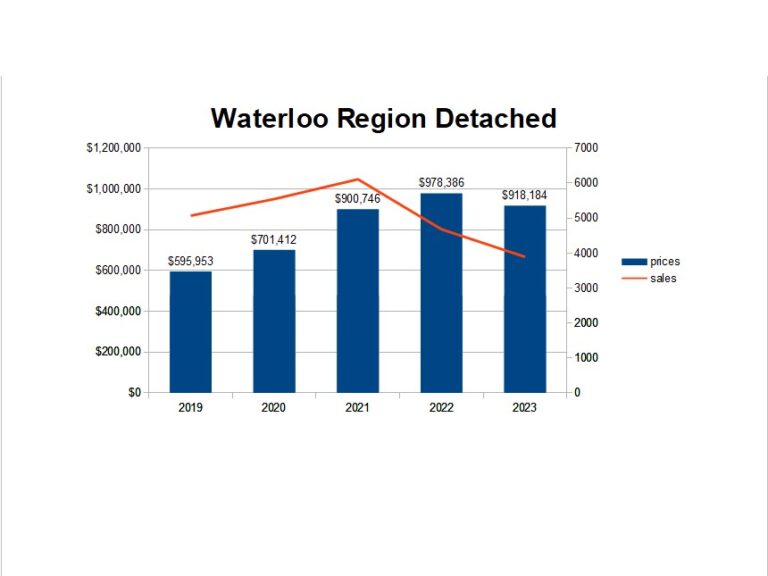

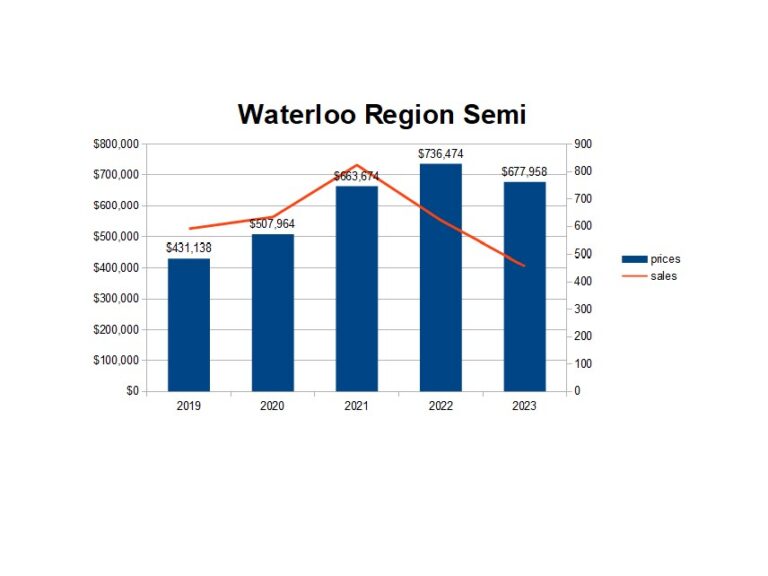

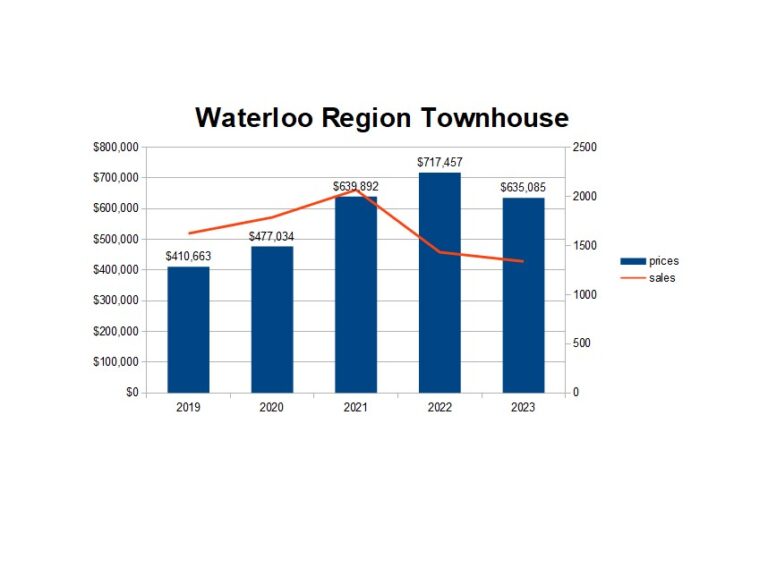

Average prices for the 2023 real estate market remain lower than the valuations we saw in 2022 but only moderately so. That we’d see declines isn’t surprising given our current rate environment relative to the 1% overnight rate and bullish market activity we saw in late 2021/early 2022.

But prices are higher than the 2021 figures and we could easily see parity with the 2022 average if a typically busy spring market arrives. Right now the average price in the worst performing category is only $65K lower than the 2022 value. Swings of this magnitude (up or down) within the year are not uncommon in our marketplace.

In a reflection of the slower market we’ve seen this year, sales of semis were down 27% on volume relative to the 5 year average. Detached for the year came in lower by 23%, followed by townhouses at -19%. Apt. style condo sales for the year were relatively strong by comparison, down only 9% against this metric.

Not surprisingly, days on market and months of inventory have both risen in response to a slow 2023 real estate market. For the last several months we’ve been in a balanced market, with roughly 3 months of inventory. Days on market has crept up since the summer months with sales averaging 30 days in December.

Going forward into the new year there are several developments on the horizon that will impact the housing market to some degree. But first let me lay out a quick overview of our market, one that is driven by supply and demand. The former is somewhat constrained, by things like materials costs, bureaucracy and red tape, access to financing, and a very tight labour market in the skilled trades.

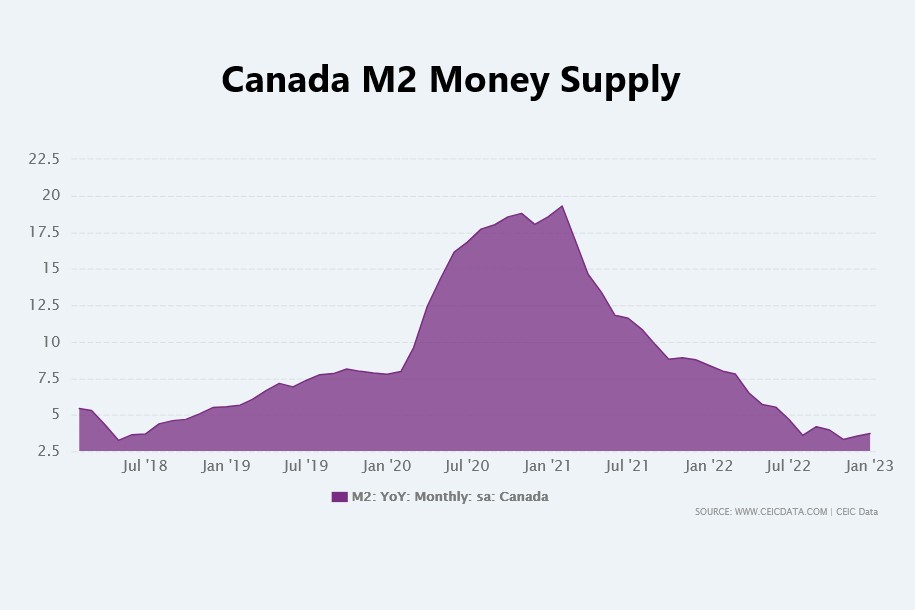

Demand is far more elastic. Generational wealth transfer, immigration, well paying employment and lax rules on foreign ownership have all played a role in rising prices over the past decade. People relocating to the region from the GTA is significant. But the biggest factor by far was Covid-19 and the government’s response to it. Massive spending and the incredibly low rates brought in by the Bank of Canada led to a huge increase to Canada’s M2 money supply fuelling huge gains in prices right into the spring of 2022.

With almost all of these demand pressures working against tight supply it isn’t entirely surprising how muted the ‘correction’ has been, driven almost entirely by interest rate hikes. Average prices here in the region are sitting mostly at par with the 2021 figures, more than 50% higher than pre-pandemic values.

Forecast for 2024

One of the developments I’d mentioned pertains to rates. There’s talk south of the border about lowering rates several times this year. If that likelihood occurs it’s almost a certainty we’ll follow suit. But the decreases will be modest at best, perhaps 25 basis points at each meeting.

Immigration has been increasingly in the news as well, with record numbers of newcomers over the last couple of years. This appears to be driven by the ideology of The Century Initiative as championed by the federal Liberals. We are starting to see a bit of push back from the public and media about just how high these numbers have been.

Lastly, there have been many promises made at the federal and provincial levels about building more housing but I think it’s all a little too late and definitely nowhere near enough to meet demand.

With that being said, I think prices will pick up once again in the spring like they usually do. But rates will not be lowered enough to cause a big bump in prices despite the huge influx of people into the country. Our market will continue on as it’s done over the past year and a half, with relatively stable prices and muted sales volumes over the next 12 months.