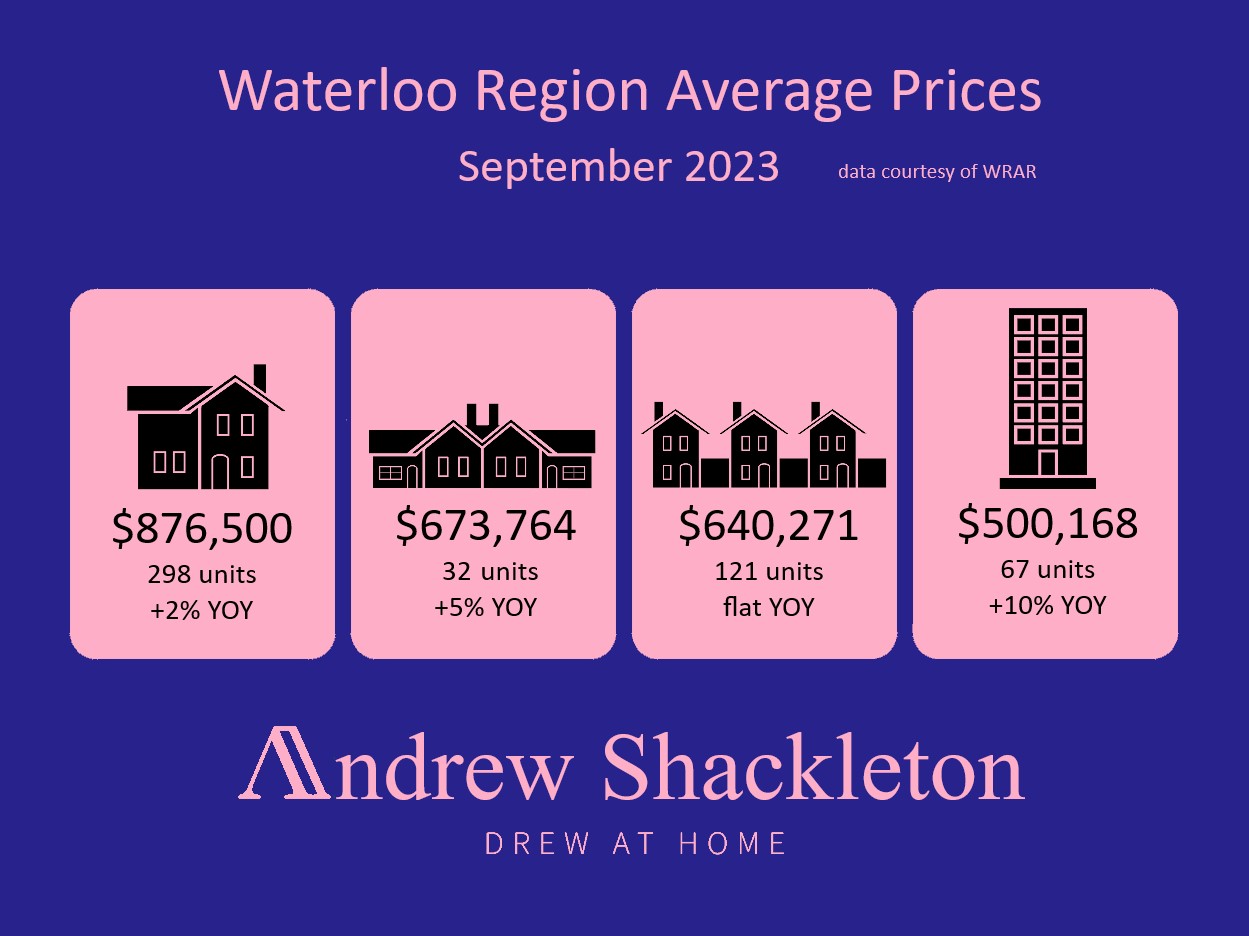

This summer’s slowdown in housing market activity continued into September here in Waterloo Region. There were 527 properties sold last month, a figure very close to the 10 year low seen in September of last year. On a month over month basis, Waterloo Region home prices have held up well, with townhomes the only segment coming in lower. Compared to last year, prices are up in every class except townhomes which remained unchanged. Read the WRAR press release.

The biggest shift in our Waterloo Region housing market is available listings. Last month there were more than 1450 properties for sale, moving our market ever closer to balanced or neutral status. According to my data we haven’t seen this level of inventory in September since 2015. More listings is obviously very good news for buyers, regardless of price. In the medium term bidding wars and over-asking percentages have to come down except for perhaps the most desirable homes.

There’s little doubt that rates are behind this. Raising them was all about creating demand destruction and our low sales volumes is proof this is occurring. But the inventory numbers we are seeing may also be rate driven. There are owners of all types who are being squeezed during refinancing. Certainly investors with cash flow negative properties are choosing to sell or are being forced to by their lenders.

Ordinary owner occupiers are under pressure too. If they’d bought back in 2019 or 2020 with a 2% mortgage the prospect of a 6% loan has to be daunting. And with rates staying flat at minimum there’s no relief coming in the next little while. This too will add to inventory, moving the market further into buyer territory. FYI the Bank of Canada’s next meeting is October 25th.