Have you ever wondered about the performance of Canadian real estate as an asset class? How has it done against other investment opportunities? What about inflation? Are returns driving prices higher still?

Canadian real estate as an asset class handily outperformed the TSX, government bonds and the CPI since 2010.

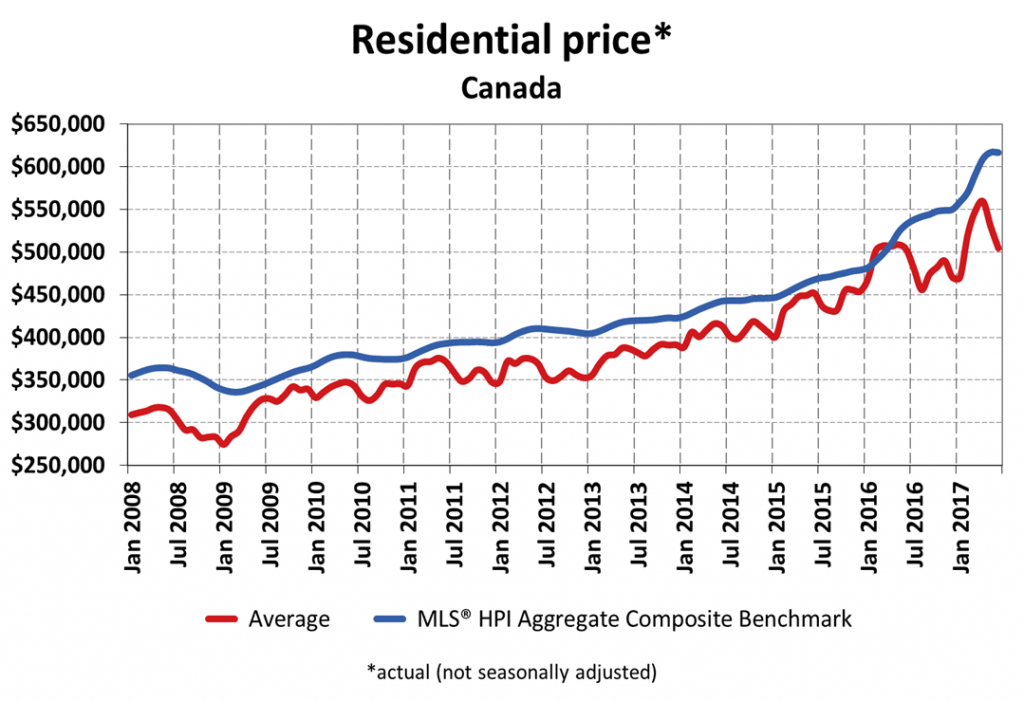

Here’s a look at CREA’s national numbers

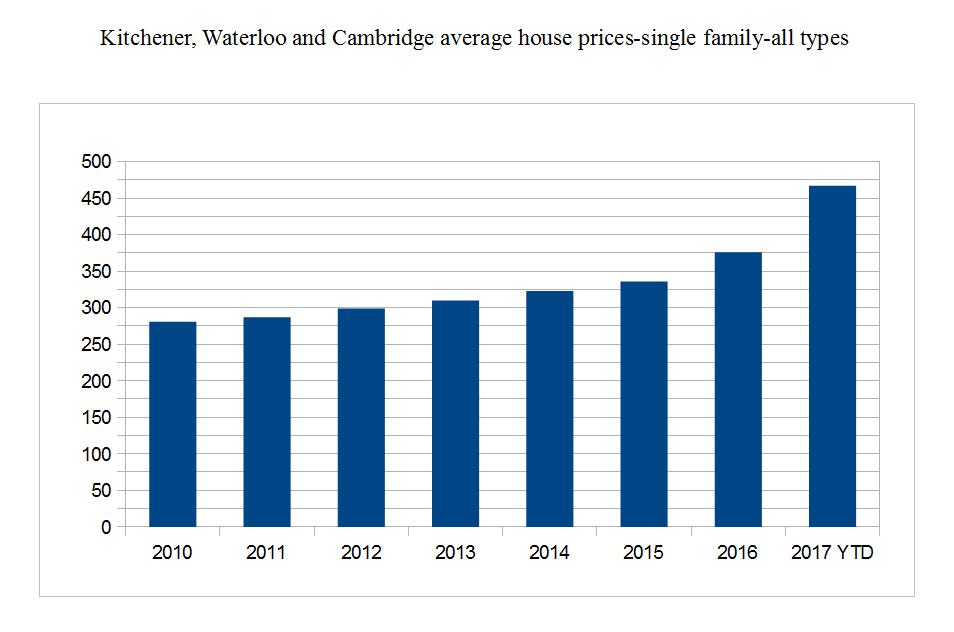

Our local market parallels this graph fairly well albeit at lower prices overall

These are the percentage changes for KW and Cambridge YOY since 2010: 2%, 4.5%, 3.5%, 4%, 4.3%, 11.6%, 24% and here’s the TSX below by comparison

source: tradingeconomics.com

The TSX has brought in returns of roughly 3.6% per annum over the same time period.

What about bonds? How have Bank of Canada 10 year bonds done? Not much as you can see below, but your money is probably safer here than anywhere else.

source: tradingeconomics.com

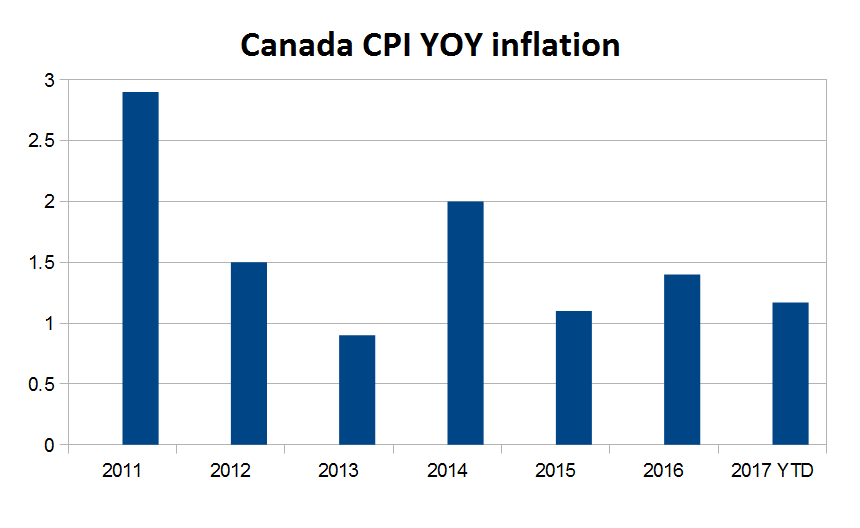

Have a look at the CPI numbers over the same period:

It’s obvious that the relative stability and security of property ownership is a big factor in anyone’s decision to own property. Low interest rates, healthy economic performance and positive consumer sentiment are also contributing to the health of our market.

The performance of Canadian real estate as an asset class is very likely putting additional upward pressure on housing prices from the speculative and investment communities both here and abroad. There is no question that Canadian dollar weakness is playing a part in the health of our real estate market.

As the graphs indicate, where else should you invest in Canada? Money tends to go where it can earn the biggest return, and that place for the past eight years or so, is housing.