Buying a home can be a stressful experience for the first time buyer, and understanding the process can make the journey a lot easier. Being I’m a helpful guy I’ll tell you how to buy a home yourself in Kitchener Waterloo, if you wanted to.

First off you need to see what you can afford and the usual rule is a maximum of 35% of your gross income for taxes, heating, mortgage payments and ½ your condo fees (if applicable). A maximum of 42% of your gross income is used if you have additional debt payments. The percentages are known as the GDS and TDS ratios and aren’t cut in stone, there is usually a bit of wiggle room.

Here’s a great calculator for GDS and TDS. CMHC debt service calculator

Once you know how big a mortgage payment you can have, you need to use that number to calculate your maximum mortgage size. Play around with the numbers because rates, amortization and other factors greatly affect the results.

Here’s a great mortgage calculator: Scotia mortgage payment calculator

Now that you’ve got a good idea of what you can borrow you’ll need to have at least 5% of the loan value saved for the down payment. Cashing out investments, borrowing from your RSP, getting a gift from a relative and using cash from your bank account are all acceptable sources.

Next stop is a lender, be it a bank, credit union or a mortgage broker, to name a few possibilities. These folks will do a detailed check on your credit worthiness, so bring along documents proving your work history and verification of income, residency, photo ID, T4s, bank balances etc. You are looking to get pre-approved for a mortgage and the lender should be able to do this for you in 3 to 5 business days.

Once you’ve got your pre-approval letter, you’ve got some serious buying power in hand and you can begin to hunt for a home. Checking out my listings is the easiest thing imaginable. And you can keep an eye on for-sale signs, open-house signs, comfree, the newspaper, Kijiji, realtor.ca and local real estate brokerages too.

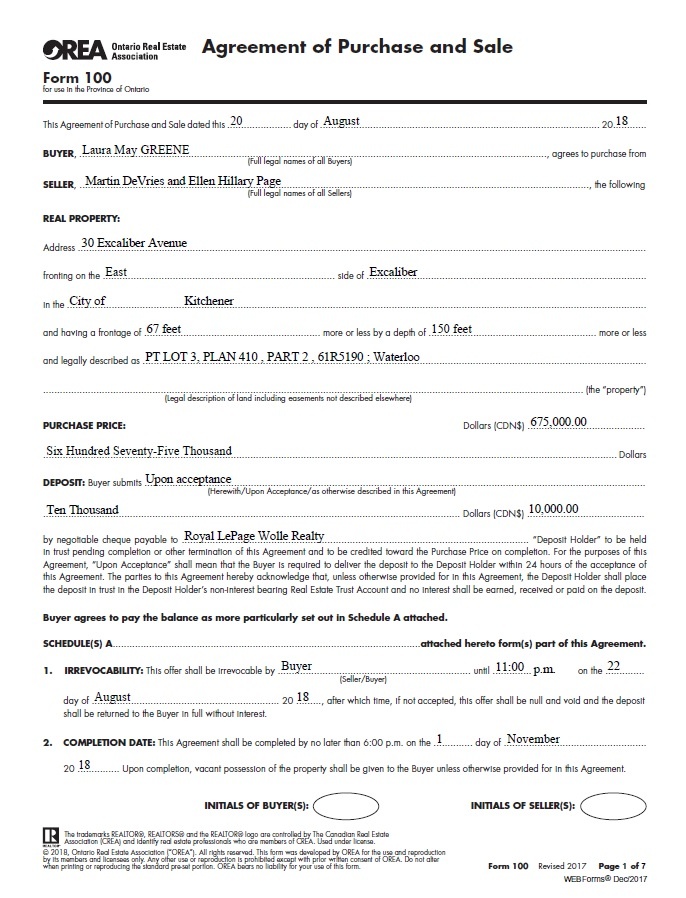

If you find a home you like you’ll need to write an Agreement of Purchase or Sale (AOPS) on the correct form. The AOPS is a contract so be careful and include all the required information. You will include several things that are negotiable including down payment, purchase price and closing date. Other important things you may consider including are conditions for financing, insurance and a property inspection. If something is important to you, include it in the contract.

Be very careful as the AOPS is a binding contract once accepted by the seller, and also has an irrevocable period after you present the AOPS that is binding too.

You can also get a real estate lawyer to draw up the contract if you are worried.

The seller may accept your AOPS, reject it outright or send it back with changes. You’ll need to be very careful and acknowledge any and all changes to the AOPS. Initials, signatures and dates are critical.

Once you have an accepted AOPS, you’ll need to get copies of the AOPS and listing sent off to a real estate lawyer of your choosing, to your lender, and to your insurance company. Depending on the terms of your AOPS you will need to drop off a deposit cheque to the seller or agent within the time frame stipulated in the AOPS.

Here’s a great insurance company: Jeff Lyle

Here’s a great real estate lawyer: Victor Hussein

If you have conditions in your offer they will need to be met within the time frame stipulated. If there are issues with meeting your conditions you can renegotiate or even get out of the deal completely depending on how you’ve worded things in the AOPS.

You’ll meet with your lender who will provide you with a mortgage commitment letter if the property passes the lender’s criteria. You’ll need to get confirmation that your insurance company will cover the home too.

If the deal has firmed up (meaning your conditions were met or waived) the next step is the requisition date for the lawyers. Hopefully you picked a suitable date on your AOPS.

You’ll want to set up and transfer any utilities not taken care of by your lawyer for the closing date, and hire a mover and line up friends and family as needed.

Here’s a great mover: AMJ Campbell

A week or so before possession date your lawyer will contact you to set up a meeting for the closing. You’ll sign a whole pile of papers, pay your lawyer and any applicable land transfer taxes and wait for everything to be squared up by the lawyers. They will have already calculated all the adjustments for taxes and utilities, and the balance owed at closing. On closing day the lawyers will transfer title, you will provide the down payment less the deposit, your lender will transfer the remaining balance owed subject to the adjustments I mentioned, to the seller’s lawyer, and finally you’ll get your keys!

It’s move in day, congratulations!

P.S. if this seems a bit much and you don’t want to buy a home yourself, I’m here to help and you don’t even have to pay me for my services. My commission comes from the sale of the house and is paid by the seller. Have a look here for some additional resources: info for buyers. Or even easier shoot me an email or give me a call…