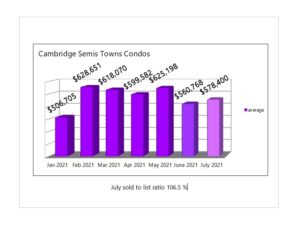

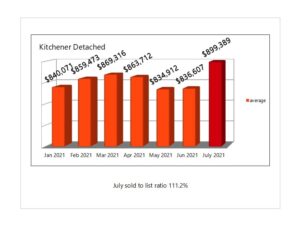

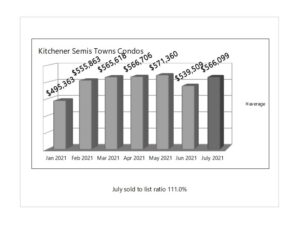

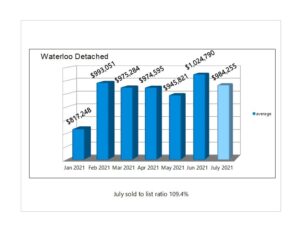

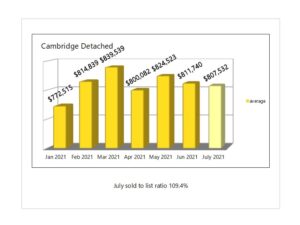

Here’s a mid July look at house prices in Waterloo, Kitchener and Cambridge. There have been some significant swings in both directions on a month over month basis. Waterloo and Cambridge saw declines in one sector and increases in the other, with both of Kitchener’s segments higher.

On a year to date basis both segments in Cambridge and Waterloo were lower. Values for Kitchener condos, towns and semis were unchanged. In contrast there was a sharp rise in Kitchener detached relative to prices seen earlier in the year.

Fluctuations aside, in every section real estate is substantially higher than the January figures and we are somewhere around 30% higher on a year over year basis.

Sold to list ratios for house prices this July are running at roughly 110% which is indicative of a strong sellers market and frequent bidding wars. This number is down substantially compared to the spring figures which came in as high as 116%. Typical sold to list ratios are in the mid to high 90’s in balanced market conditions and it is clear we are still far away from that.

We are seeing signs of inflation here and in the US which could very easily lead to interest rate hikes by the Bank of Canada and the Federal Reserve south of the border. And this would certainly carry over to our mortgage market as rates are closely linked to the US Treasuries market. This could dampen demand and even affect prices to the downside but it is hard to say by how much given our low supply of inventory relative to demand.

The covid situation appears to be vastly improved here in Canada but that can’t be said for the rest of the world. And even locally I am hoping we don’t see a 4th wave. A return to normal would be the optimal outcome for everyone but that’s doubtful given low vaccination rates in so many places.

We remain in uncharted territory with the pandemic and how things will be impacted on an economic front. Thus far governments worldwide have been doling out cash like it’s the lottery. This has had a big impact on house prices we are seeing this July, and in the run up over the last 16 months too. These levels of spending are unsustainable and clearly inflationary and need to be reined in sooner rather than later. We live in interesting times!