Should I sell my house this year? That’s a tough question and the answer very much depends on your personal goals. The market itself is something you absolutely must consider as well. Buyers should keep an eye on it too I might add.

If you were looking at cashing out of real estate completely, you’re probably late to the party. That’s not to say you wouldn’t earn a tidy profit relative to 2020 prices, because you would. But you have certainly missed out on a third of a million or more in additional profit if you’d sold a detached Kitchener Waterloo home in February.

Cashing out aside, the question of ‘should I sell my house this year?’ is something that requires careful consideration. The price you get today (or tomorrow) is what it is, the price someone else is willing to pay you at this particular point in time. The price you get in the future may not be the same at all. This can wreak real havoc on your plans if you are buying something else. This potential chaos is dependent on two things, market conditions and the order in which you buy and sell your real estate.

For much of 2020 and all of 2021 selling your home before buying another was the wrong strategy. The market was going up so quickly that you could find yourself paying tens of thousands more than you’d expected (or budgeted for) on your next property. This was especially true if you took your time buying. Bidding wars were the norm as well. There were many months where prices were rising by $10,000 a week or more.

The perfect strategy at the time was to get out looking, buy your next home, and then sell your existing home. If you’ve juggled things correctly with your closing dates you wouldn’t end up homeless in between. And if you didn’t find anything you liked you still have a home to live in.

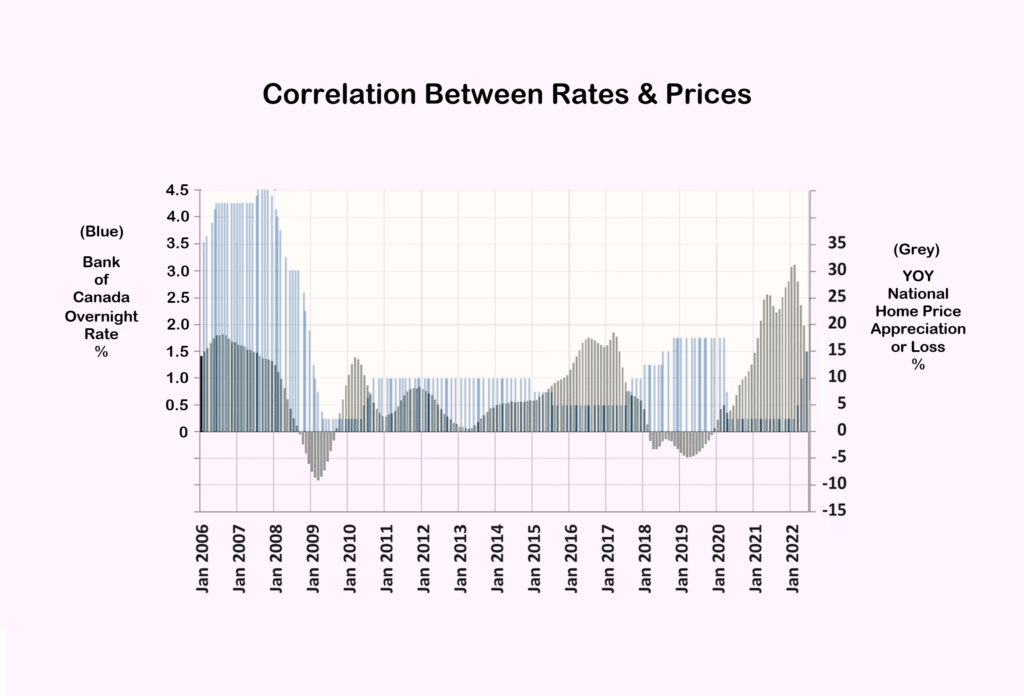

There’s risk with everything of course. This scenario works perfectly in a red hot market, but isn’t good at all when the tide turns like it did early this spring due to rapidly rising interest rates. Take a look at the very right of the graph below and you’ll see year over year gains rapidly nose diving.

Now you’ve paid too much for the home you just bought and have to sell the current home for less than you expected. The sellers who got this wrong are feeling some deep financial pain right now.

Selling first is the way to go right now and into the fall of 2022. We’ve seen months of decline across the board in all sectors. Prices on detached homes are down roughly 30% since the February highs. With inflation still out of control here and in the US more rate increases are coming, putting additional downward pressure on our real estate market.

With this negative trend it only makes sense to sell first and buy second. You’ve locked in your price and can potentially save on your purchase if you’re lucky. This happened earlier this spring for some clients of mine. They sold a townhouse for more than they ended up paying for a newer detached home. It was luck for sure but I’d like to think my marketing helped.

Market conditions and strategies aside, people’s personal reasons for selling are ever-present. Divorce, relocation, inheritance, up-sizing or downsizing, retirement, health issues and changing investment goals are just some of the motivators I come across.

Time and market timing factors into some of these things and not others. Moving up or down the property ladder will be relatively safe. But selling that investment property you bought 10 months back might not be. In this case if you’re cash flow positive each month it might be best to hold instead.

And divorces and health issues often can’t wait. Should I sell my house this year isn’t really a question. In these situations I’d advise you to do everything you can to maximize price right now. This really should be your goal in any market, good or bad. If your home looks better than the neighbour’s for sale up the street you’ll get more bucks. Need some resources to plan your sale?

One last thing I should mention is timing. It’s very hard to do. We are in a falling market. But it’s still a sellers’ market despite being down 30%. Inventories are up, doubled in fact, but are still well below neutral territory. So it’s a bit of a crap shoot trying to predict the length of this downturn. RBC thinks things will turn around early next spring. That seems reasonable enough. The rate increases will eventually bite and once that occurs the Fed in the US and the Bank of Canada here will pause on further increases.