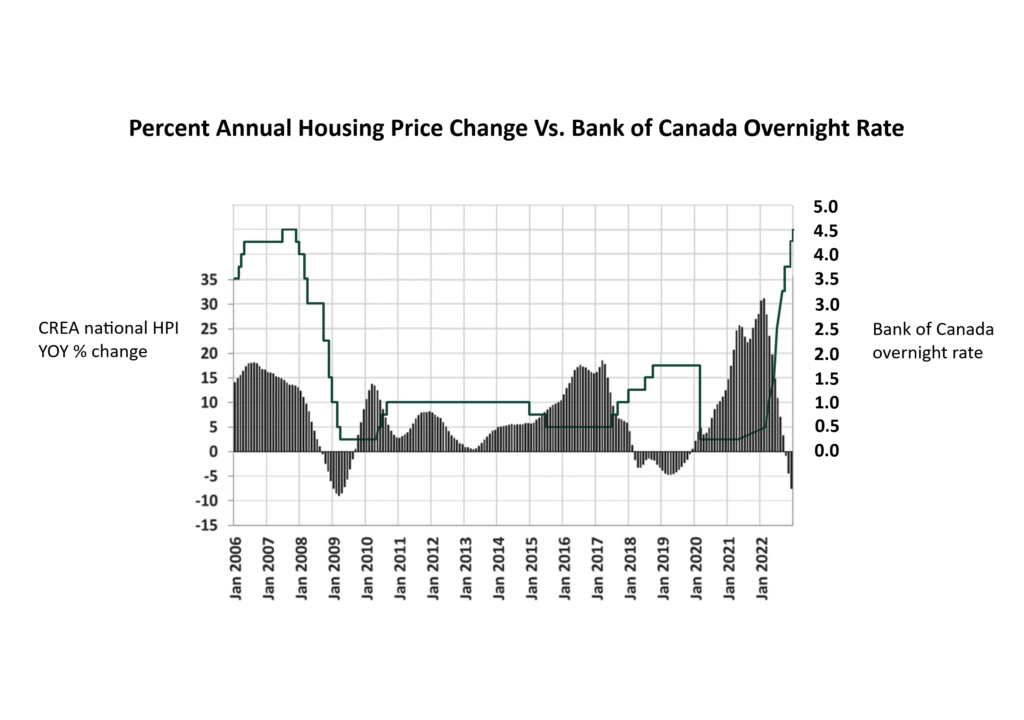

As predicted by many, the Bank of Canada increased the key overnight rate again, this time by 25 basis points, bringing it to 4.5%. This interest rate increase is half as big as the last two rate hikes in October and December of 2022. It’s clear that the Bank believes inflation is slowly being reined in but isn’t fully conquered yet.

The overnight rate is the rate the Bank of Canada charges major banks and credit unions to borrow money. It’s a key factor in the economy, impacting everything from borrowing and spending to investing and saving. The US version is colloquially called the fed rate and is established by the US Federal Reserve.

Mortgage rates here in Canada are based on these benchmarks and by the value of longer term US Treasuries, a type of bond. If the overnight rate goes up so does the interest paid out on US Treasuries, dragging our mortgage rates higher as well.

The higher interest rates we are seeing now are a direct result of monetary policy brought in during the early days of the pandemic. The US stock market saw the sharpest drop on record in March of 2020. Our TSE was similarly affected, sinking back to 2016 values. The Federal Reserve Chair, Jerome Powell slashed rates to almost nothing and our Bank of Canada Governor, Stephen Poloz did the same thing here.

Unfortunately rates were left low for a little too long causing unintended inflation in the form of higher wages and prices. The war in Ukraine and supply chain issues due to covid worsened the situation. High real estate prices in Canada and abroad are also linked to low rates.

One of the key ways central banks manage inflation is by interest rate hikes. Making the money supply more expensive reduces consumer and business demand which moderates wage and price increases. But when inflation spirals rapidly out of control sharper increases are necessary, just like we’ve been experiencing for the last year.

Interest rate increases and decreases take some time to impact the economy. The moves the Bank of Canada made today with the overnight rate will probably be felt 6 months out and not next week. A 0.25% increase definitely points to inflation slowing down. The bond market would agree. The yield curve on US Treasuries is inverted with 2 year bills paying less than one year or one month instruments. A recession is entirely possible.

If you’re looking to buy or refinance you definitely need to do a deep dive into this stuff with a mortgage professional who knows their stuff. Personally I’ve always been quite risk averse with regard to variable rate mortgages but I’m not convinced at this moment that I’d want to be locked into a 5 year fixed either. There’s plenty to think about.