February was a quiet month for real estate here in Waterloo Region The snow we saw over the past few weeks was bad enough that I bought a snowblower. With several feet of snow on the ground, looking at properties was a real challenge and many buyers chose to sit things out, no doubt staying inside where things are considerably warmer.

The start of the month saw a real ramp up in rhetoric from Trump and his ilk but little in the way of any actual economic damage. Discussions between Trump and Trudeau were quickly held, with possible tariffs being pushed back to March 4th.

TD Economics believes that we were in for a year of solid economic growth that may now be dampened down considerably if trade disputes are not solved quickly. Being that these developments are happening in real time, February’s figures only reflect a combination of poor weather and the typical slowness of the winter months.

The flatness of the past few years continued into February, with the market seemingly stuck in a holding pattern with regard to price. If there is a trend I’d say it would be ever so slightly negative.

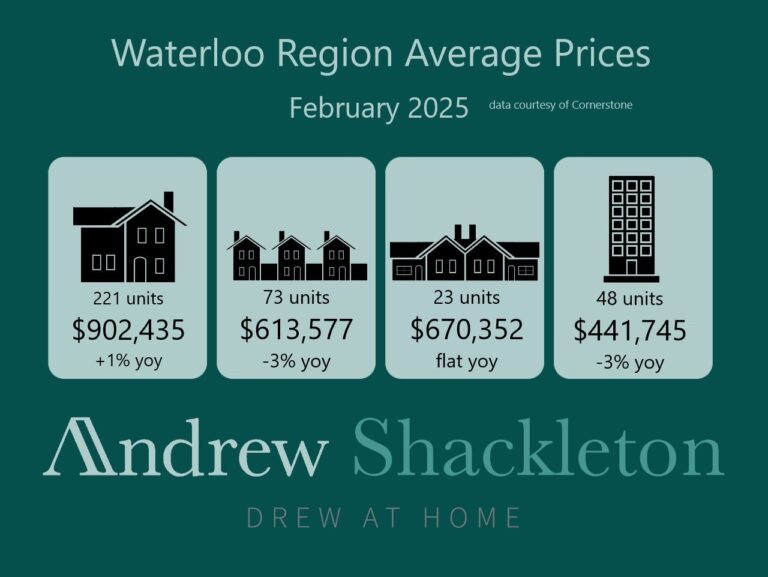

Detached prices edged up by 2% compared to January, and 1% YOY. Semis saw a bump of 7% compared to last month but remained flat on the year. Towns and Apt Condos were down 3% YOY and were also lower compared to January, coming in at -3% and -5% respectively.

What we are definitely seeing is an increase in inventories across every segment, especially in apt style condos, now sitting at 8.3 months. There are more town houses available as well, perhaps due to a change in investor sentiment. There’s 5.6 months of stock, solidly in neutral market territory. Detached and semi-detached properties came in at 3 and 2.5 months respectively. These latter two still favour sellers, but much less so than before.

With renewed economic uncertainty on the horizon there’s little doubt the Bank of Canada will move on rates at the March meeting. How much is the only question at this point, although 25 bps is the bare minimum we’ll see in my opinion. Cuts in our rates weaken our dollar and should offset some of the damage a trade war will cause.

Longer term, a protracted dispute between the US and Canada is simply not possible. Our economies are way too intertwined, and tariffs will hurt the US as well. Business leaders will get Trump’s ear if they find themselves losing money. This is true of senators and congresspeople, if they find themselves under attack from voters and unhappy laid off workers.

Going forward, I think the spring real estate market in Waterloo Region will be slow until some sense of normalcy returns between Washington and Canada. When that happens, and it will, market activity will pick up once again. You can read my board’s take on things here.