There’s no question the house prices decline we’ve seen in April is tied to stock market turmoil and the Covid 19 pandemic. Analyzing recent events is easy enough but looking forward is another matter entirely. And I don’t have a crystal ball so making predictions about house prices 6 months to a year out is a bit of a fool’s game.

I’m certainly not going to be making any kind of bold claims such as “Housing Prices In Canada Immune To COVID-19…” as The Huffington Post said. And I won’t be typing things like “Canadian Home Prices Expected To Drop Up To 30%” as claimed by Moodys. Both statements can’t be true at once, and I don’t know one way or the other what is going to happen. If I had a crystal ball when I needed it I’d be retired on some tropical island slurping on a margarita.

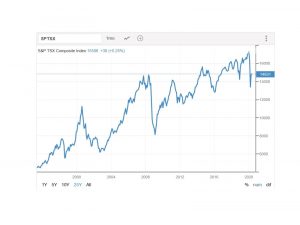

What I will say is that economic shocks like the one we are in have predictable outcomes, and this ties into the housing market. A look at historic stock market data and the study of probabilities can give us an idea of where things may end up longer term. And a peek at our March and April numbers provides some guidance in the short term.

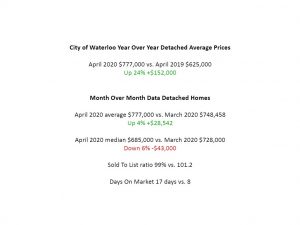

April and March Prices

It’s no surprise that we’ve seen a month over month drop in house prices in Waterloo Region and Guelph. The pandemic hit full stop mid March shutting down everything in its wake. The effects of this on the local real estate scene were readily apparent by mid April as I discussed in my 1st Covid 19 video.

Since then we’ve seen a small improvement but overall April prices are lower than the previous month. The average price for a Waterloo Region detached home was down 2.5%, with the median coming in 5% lower than the March figures. Guelph fared much worse month over month, down 8% on the median and 8.4% for the average detached sale price.

Volumes are sharply lower due to fear, layoffs and restrictions on showings. Open houses are currently illegal with no time frame on when that may change. Waterloo Region had 66% fewer sales month over month and Guelph came in 60% lower.

In the next couple of months I expect the market to pick up a bit on volume and on prices. We are in the busiest season for sales and buyer interest hasn’t evaporated. People are getting used to navigating the Covid environment be it for work, groceries or looking at homes. My anxiety has certainly subsided despite a mask at the ready for public spaces. Buyers and sellers are no doubt relaxing a little bit more too.

The Picture A Year Out

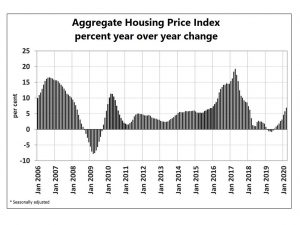

But the outlook for prices over the next 6 to 12 months is murky. Because real estate is illiquid and immobile compared to other assets it takes longer for prices to move in response to the economy. Real estate is a lagging indicator and can trail changes to the economy by up to a year.

This is the nature of economics as it applies to real estate and we are right in the middle of a sharp economic contraction. But it’s far too early to make any kind of longer term prediction on price. The million dollar question is how long will this last?

This is especially important, because our entire world economy is barely treading water and only due to massive injections of government money. At some point soon people need to get back to work and businesses need to reopen.

What will this look like? Will covid quickly return if we are too soon or too careless? How many businesses end up finished? How many people lose their jobs and their homes? Or will the huge injections of government cash get the economy back up to full steam quickly? Will the stock market continue moving upwards and turn into the V shaped recovery some are predicting? I can’t answer this. But I can give you some probabilities to work with instead.

Our stock market and our neighbour’s down south were recently in bear territory, defined as a drop of 20% from market highs. Whether covid caused or not, we were overdue for a correction. Twenty percent drops occur on average every 7 years. The market has rebounded but that doesn’t mean we are out of the woods. Bear markets have a 60% chance of turning into a full blown recession.

60% is close to a coin toss. If the stock market recovers over the next 6 months and doesn’t turn downward again housing should do well overall. But what will happen to house prices here in Canada if things do worsen? It all depends on the length and severity of a potential recession. Things could be bad or we could see a repeat of ’08/’09 when house prices declined a mere 7% and quickly recovered.

Probabilities and and a look at recent and historic data is what I can offer you with certainty right now. I don’t have a crystal ball and no bold predictions will be made here. Longer term the trend for real estate is positive, as it has been almost my entire life. But stock markets are risky by nature and tie into much of what we do, including real estate. So keep an eye on the markets and know that there’s some short term risk if you are buying or selling property in the next year or so.