It’s now mid way through June and I realized the other day it’s been more or less 3 months since the pandemic shut the country down. I can recall not shaking peoples’ hands at a Toastmasters meeting in early March and how weird that seemed. That was when things suddenly got serious.

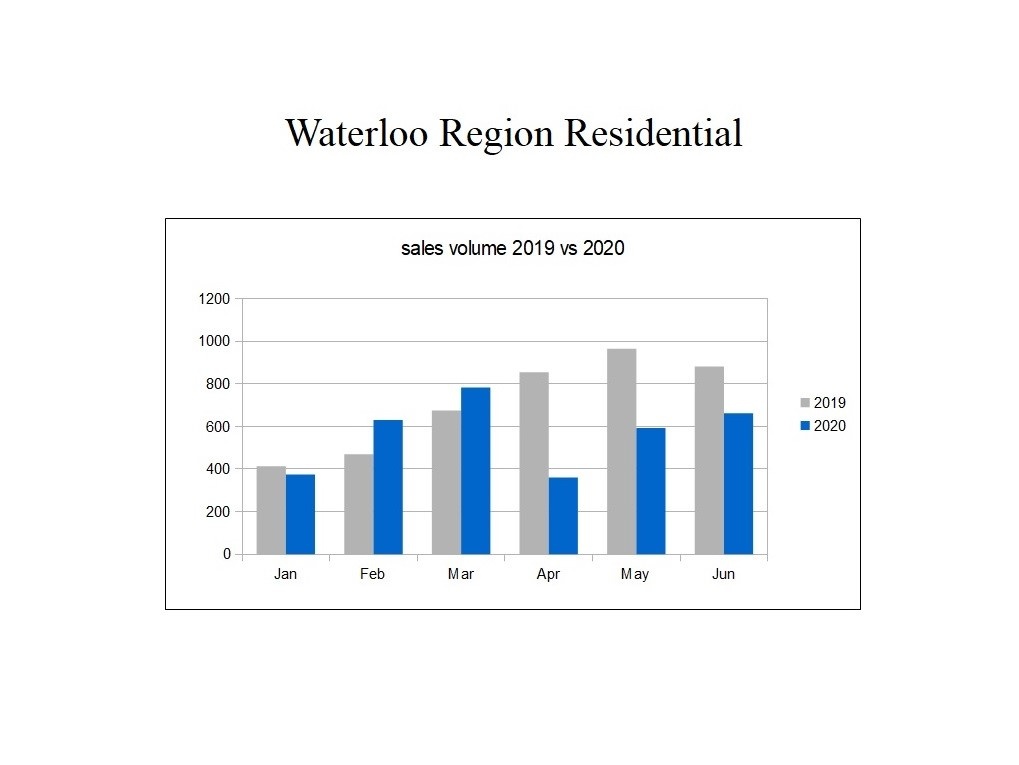

The virus was already on my radar because of the stock market, but I couldn’t have guessed how quickly everything would slam to a stop. We were in for a busy real estate market and then we weren’t. Sales volumes were halved and I wondered how badly house prices would be hurt.

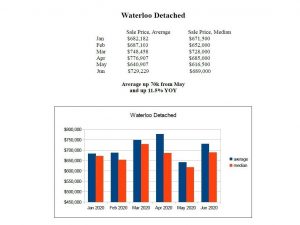

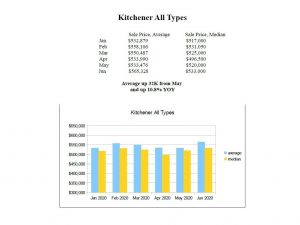

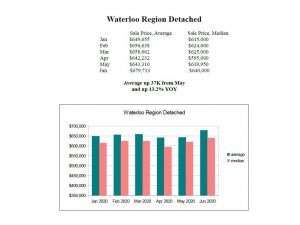

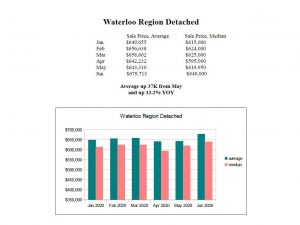

We did see some very steep price reductions in Guelph and Waterloo in April and May. The economy and society were paralyzed by the pandemic. The real estate market was hit too, with reduced buyer demand pushing prices to the downside.

But people adapt. Societies learn to function with changing circumstances. Demand didn’t go away, only taking a pause while people figured out how to stay healthy. The balance of supply and demand never shifted in an appreciable way toward buyers for more than a few weeks. We had tight inventories compared to last year even before the pandemic and that situation has only worsened for buyers.

Once buyers returned to the market the early losses we saw in Guelph and Waterloo quickly evaporated. House prices are sharply higher on a year over year basis. And here we are in June with full blown bidding wars in the starter home segment. I am working with buyer clients who are seeing multiple offers on every property we bid on. One property had 22 other offers. A good friend of mine, Jeff O’Leary, bid on a home in Galt with 27 offers. By the way if you’re in Mississauga you should check him out The Village Guru

There’s normally a lull in activity over the summer months but this year’s market is anyone’s guess. I expect that prices will continue upward unless the economy takes a sharp turn for the worse. In that event it’s entirely possible that real estate prices will drop. But that could be 6 months to a year away. Property is an illiquid asset with pricing that lags far behind other economic indicators.

We definitely need to continue with the Keynesian economic policies we’ve utilized thus far to avoid tipping into recession. Business alone cannot keep the economy afloat while being in virtual lock-down. Strong government policy is essential for stimulating spending and offsetting damage to business as much as possible. Tax breaks, deferrals and programs like CERB need to continue until consumer and business spending picks up the slack.

If you are a speculator then you should know that the real estate market in the next year or so carries some risk. Market timing can be critical for short term buying or selling. Guessing which way the market will go and getting it wrong is unfortunately very easy. I play the stock market a bit and this is something I know first hand.

But longer term, housing is one of the best places to park your money, and you get a roof over your head too. If you are buying with the intent to stay in your home for 5 or 10 years what happens with house prices this year or next will make little difference. My parents bought in 1970 for $30k and their house is well over $600k now. We bought in ’97 for $150k and our home is over $700k in today’s market. Those are some great returns.