Expensive Housing

Why is housing so expensive in Waterloo Region? There are plenty of reasons of course. But there’s one rather big issue that never gets much mention in the media or online.

Waterloo Region’s economy, net immigration, and proximity to Toronto all factor into our housing market. And a lack of housing stock, foreign buyers and the investment community are also putting upward pressure on house prices.

But why is the supply of housing stock so low relative to demand? We’re building tons of housing. There are tower cranes everywhere in KW’s core. The suburbs of Vista Hills, Huron Park, Doon South , Trussler and Grand River are flooded with brand new construction.

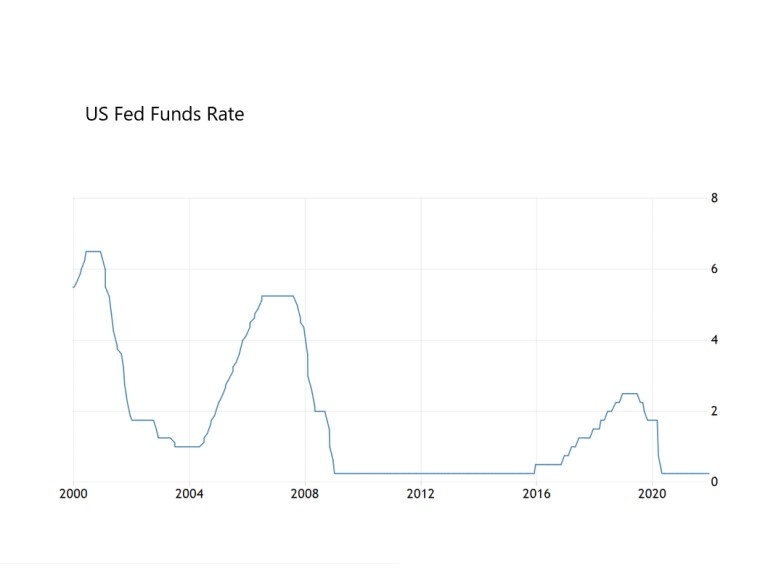

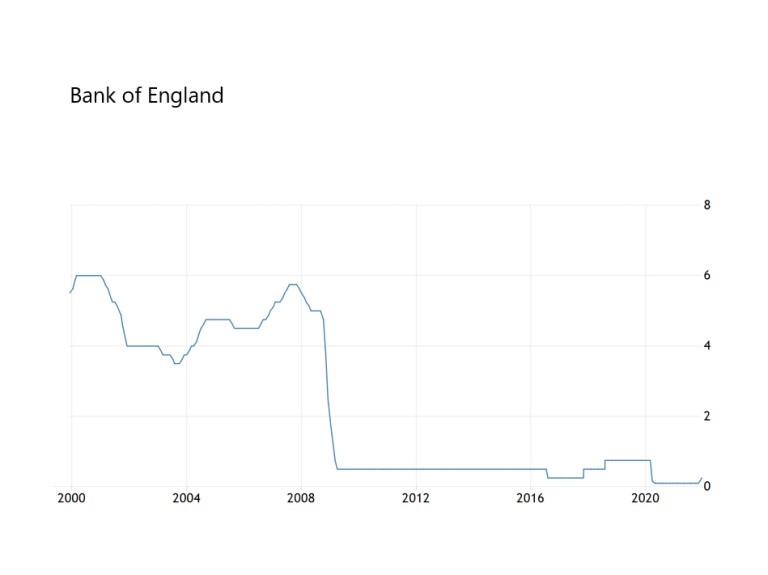

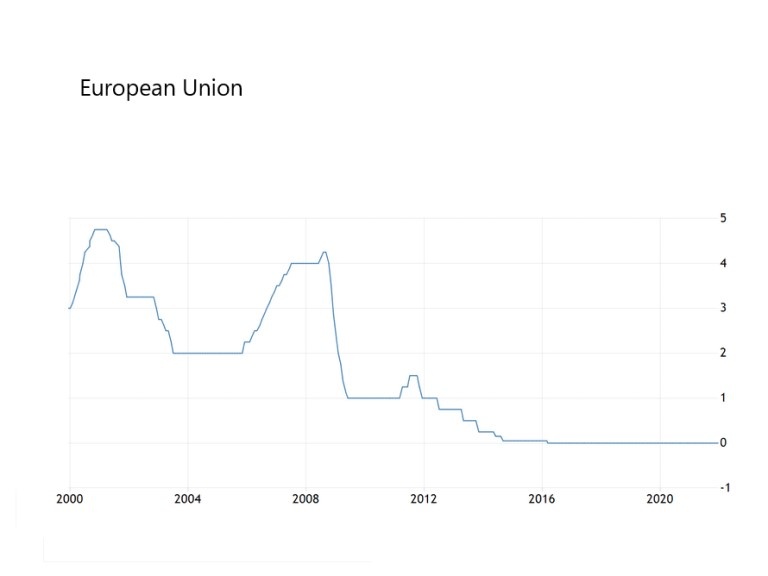

Record numbers of homes are being sold too. My local board issued a press release about this in mid January. And yet we have sky high prices. This is not unique to Waterloo Region or Canada. There are similar crises in most of the G7 economies and in plenty of other places too.

According to UBS, cities in bubble territory are Frankfurt, Toronto, Hong Kong, Munich, Zurich, Vancouver, Stockholm, Paris, and Amsterdam. The merely over-valued include London, Tokyo, Los Angeles, Geneva, San Fransisco, Tel Aviv, Sydney, Moscow, New York, Boston and Singapore.

The Interest Rate Problem

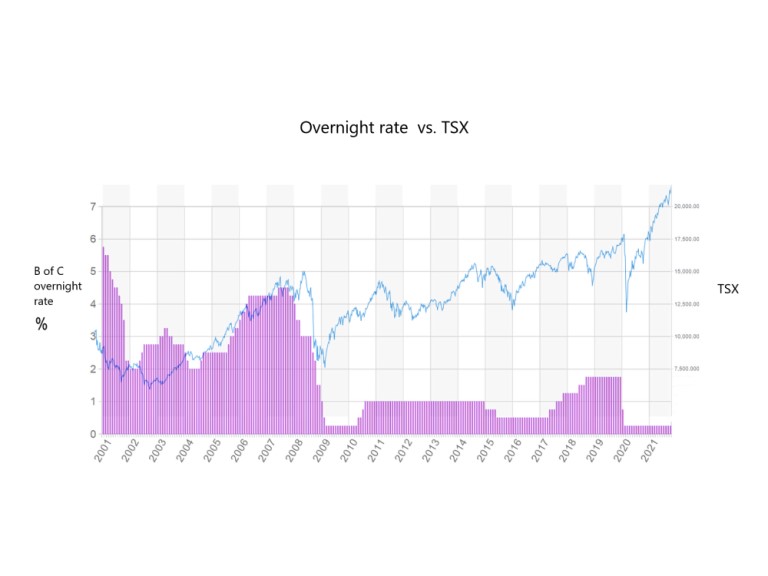

The underlying factor driving property values higher here and abroad is excess buyer demand caused by ultra-low interest rates. This didn’t happen overnight. Our high prices are the result of rates held artificially low for more than a decade.

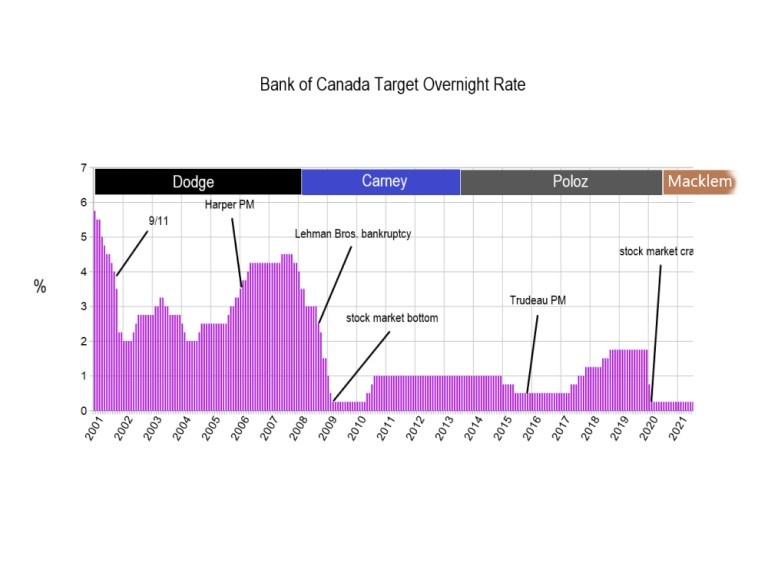

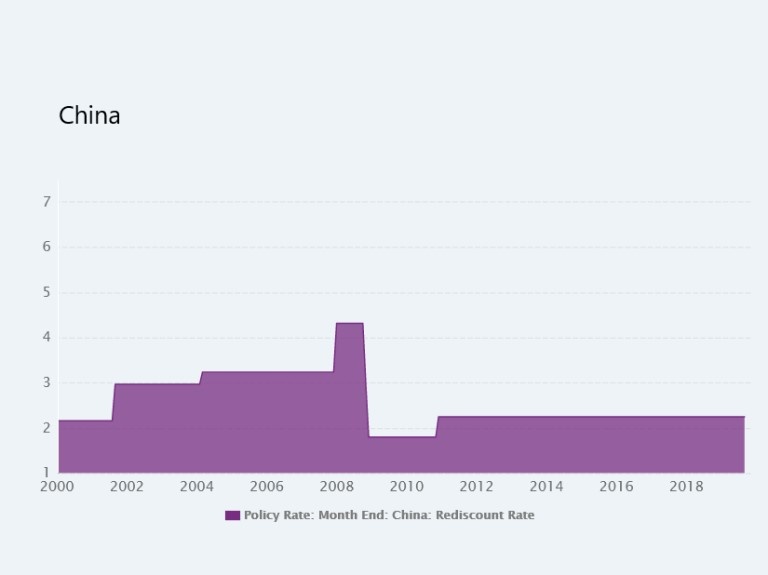

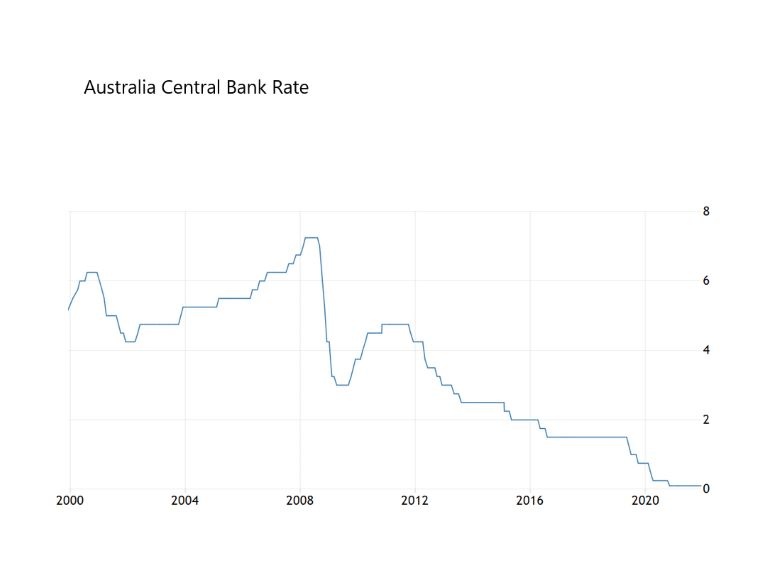

The Bank of Canada benchmark overnight rate has averaged 5.8% over the past 30 years. But the overnight rate has never been higher than 1% for ten of the last thirteen years. Rates were slashed from 4.25 to 0.25% in less than a year in response to the ’08 financial meltdown south of the border. And they’ve stayed low ever since. Other countries have taken similar drastic steps.

Investopedia.com says “Lowering rates makes borrowing money cheaper. This encourages consumer and business spending and investment and can boost asset prices.” And “The lower the interest rate, the more willing people are to borrow money to make big purchases, such as houses or cars.”

But rate policy is a delicate balancing act. It is a powerful but unwieldy tool with effects that are not always apparent right away. Changes may not be felt for several years or more. When rates are left too low, too long, excess buyer demand is created. This can happen with commodities, the stock market or with housing. And this is exactly what’s been going on with real estate for the past 5 or 6 years here in Canada.

Demand Feedback Loop

Runaway demand starts out very slowly. Buyers have an easier time getting into the market due to cheap money. This extra buying activity fuels price increases. Once values start rising foreign buyers and the investment community are drawn in looking for solid returns and a safe haven for their money. This increases demand and prices further.

Now we begin to see marginal buyers starting to panic. This is the fear of missing out (FOMO) crowd. They can’t save quickly enough to match price growth so they get in by any means possible. The fortunate ones rely on the bank of ma and pa. And this inter-generational wealth transfer adds even more upward pressure on prices.

Solutions?

It’s a feedback loop driven by excess buyer demand. But few people seem to be talking about this. Instead there are angry and somewhat ugly calls from some of the public to punish investors and foreign buyers, and to slow down or even ban immigration.

Provincially, the Ontario Real Estate Association and the Ford government offer up nothing better than ‘build more housing’. And we get the exact same suggestions from the Canadian Real Estate Association and the federal government. Finance Minister Freeland admits that “it will take years of strong supply growth” to fix some sectors of the housing market.

We could attack the demand side of the equation instead. Raising mortgage rates sufficiently will buy time for builders to catch up with demand. Unfortunately this is easier said than done.

Mortgage financing needs real reform, not the unregulated race to the bottom we’ve seen for the last decade. But the neoliberal economic beliefs of many of those in power are a big obstacle. Banks and other lenders have been given a bit too much free rein. Rapidly rising prices have made a ton of money for any industry connected to housing. And increased valuations have meant soaring tax revenues for all levels of government.

Informed Buyers and Sellers

Is writing about this shooting myself in the foot? I don’t think so. The multiple offer environment is risky for buyers, and also for sellers who need to buy something else. Rising prices have already lost me business due to a lack of affordability. My investor clients are finding it difficult to purchase property that is cash-flow positive. Still others with high salaries can barely afford a two bedroom because they are single. And of course I am worried for my children who might want to buy a property one day.

The issue of rates fuelling prices was something that popped into my head a few years back. It was one of those nagging feelings that you shove back in your mind. And I didn’t give it much more consideration until the pandemic hit. But once I saw the 2021 year over year housing data and took a look at the overnight rate I knew I was actually onto something.

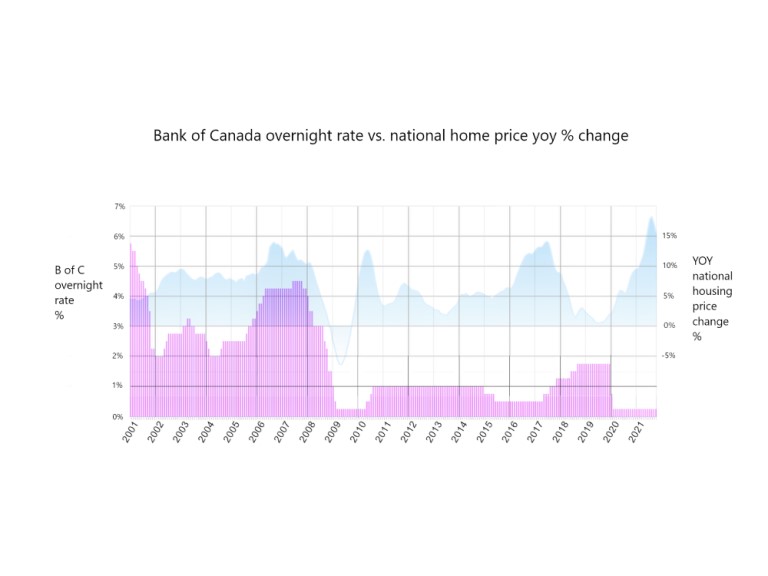

The chart I put together showing year over year gains vs. the overnight rate says it all. I don’t think you could find a clearer picture. Read on below to see how the numbers played out over the last half decade.

The Timeline

Housing costs weren’t really on anyone’s radar prior to 2016 when prices first started lifting off. Up to this point real estate was safe, secure and almost boringly stable. There hasn’t been a major correction since 1989 and the market was impacted for less than a year during the great recession.

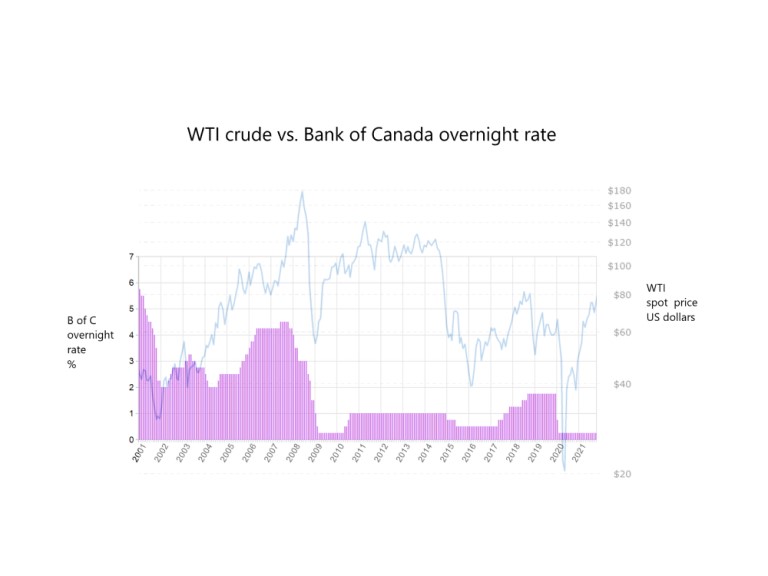

Let’s back up a bit to 2014. Oil has plunged from $120 to $60 a barrel. The TSX is trading sideways and will drop 17% over the next year. Would it be a stretch to think anyone on Bay St. who has Harper’s number is calling the Prime Minister? Same for the oil patch.

No doubt executives, lobbyists, finance ministers, Bank of Canada officials and even Harper engage in plenty of discussion about the economy. So the new Governor of the Bank of Canada, Stephen Poloz, cuts the overnight rate from an absurdly low 1% to half a percent in just a few months. This will give a boost to the economy, and hopefully help Harper’s re-election chances as well.

2015 comes and goes with little happening in the housing market. Prices are up a modest 5%. But Harper loses the election to Trudeau’s landslide. Governor Poloz, now under Trudeau, keeps rates unchanged at half a percent. There’s still the oil industry and stock market to save. This is also where housing first begins to go off the rails.

It’s now 2016 on our timeline. Oil and the TSX recover nicely in Trudeau’s first year. He’s riding high in the polls and the people love him. ‘Sunny ways’ as he loves to say. And there are government incentives galore to get people into housing. With rates so low banks are pretty much giving money away.

At the federal level little attention is paid to the 13% gain in prices seen nationally, or the 11% in Waterloo Region in 2016. And the overnight rate remains unchanged at half a percent through much of 2017, leading to another 14% jump in prices. They surged here by 21%.

But some people were concerned. Foreign buyers taxes are implemented in Vancouver and in Ontario. These measures work, albeit only briefly. However, the feds and the Bank of Canada seem unconcerned and are slow to react. It takes them almost 6 months to raise rates by half a percent in 2017 and it’s another full year before the overnight rate hits one and three quarters.

This Central Bank action is too little too late, as is the mortgage stress test brought in 2018. The stress test did absolutely nothing to prevent buying by institutional investors, speculators, the wealthy, or foreigners. This will come back to haunt us when the pandemic shows up. What the stress test did do was hurt ordinary Canadians trying to get into the market for the first time.

This lack of meaningful action shouldn’t be a surprise. On economic issues the Liberals and Conservatives are often quite similar. They believe in market-oriented reforms such as eliminating price controls, deregulating capital markets, lowering trade barriers and reducing state influence in the economy.

Housing in 2022

So here we are now at the start of 2022, with two years straight of double digit gains. Waterloo Region real estate prices are 44% higher than the 2019 figures. This surge started when rates were dropped to 0.25% by Governor Poloz in the spring of 2020. It’s no coincidence that the TSX also shot up massively in response to this fresh stimulus.

Saving the stock market and the economy at the expense of housing affordability is bad policy. But that is exactly what we’ve dealt with since 2016. And measures such as punishing investors and foreign buyers or any of the other countless solutions talked about in the media won’t do a thing to fix housing, at least not on their own.

Ironically enough interest rates are going up which might help stabilize prices. Ostensibly this is being done to combat inflation which has reached a 30 year high. Massive deficit spending and the huge pandemic rate cut are the guilty culprits here.

As I’d mentioned earlier there hasn’t been a peep about raising rates to fix housing on our provincial or federal websites. “Build more houses” pretty much sums it up. But the policy makers are not stupid people. They are certainly aware of the mess they’ve created. They know full well that big enough rate increases will dampen demand.

Here are three possible outcomes for housing: Rates won’t be raised enough and prices will continue shoot upward. Or they’ll raise rates too quickly, stalling out the economy. And then the Bank of Canada will slash rates once more and prices will surge. The third and final scenario is the hardest; getting rates just right for solid economic growth while keeping a lid on housing and inflation.

Regardless, mortgage rates need much stronger regulation. This will better align buyer interest with available properties no matter what the economy is doing. The mortgage market right now is quite simply a free for all. The fact that you can get a 5 year fixed rate mortgage for under 2.5% is a huge problem.

Price growth like we’ve seen is unsustainable and only increases the divide between haves and have-nots. Ordinary Canadians are being pushed out of the market. Rents have shot upwards as well. This cannot be good for society. Reform is desperately needed. Policy decisions in government and at the Bank of Canada need to change now.