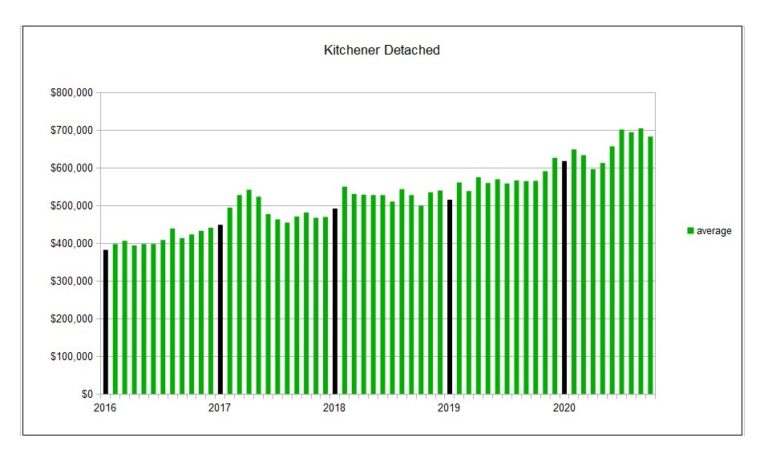

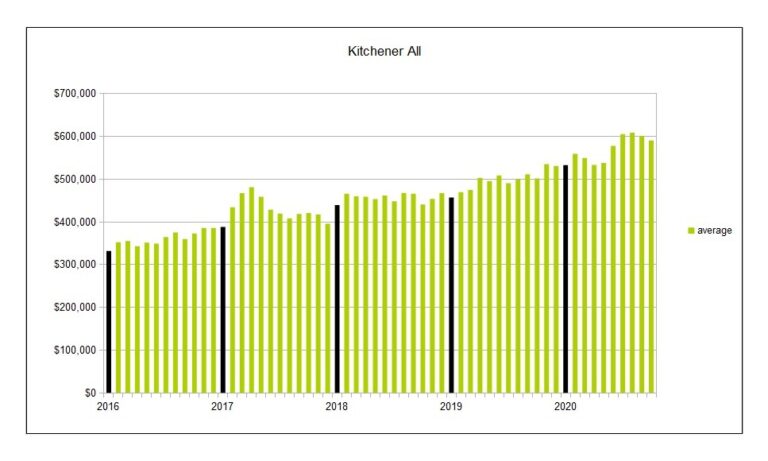

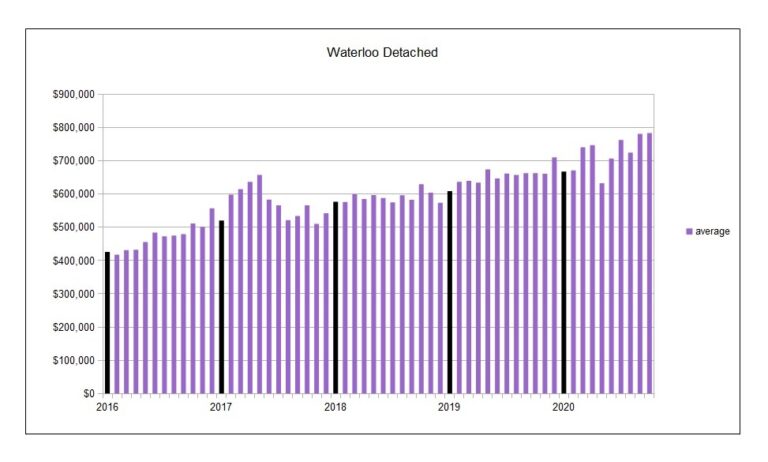

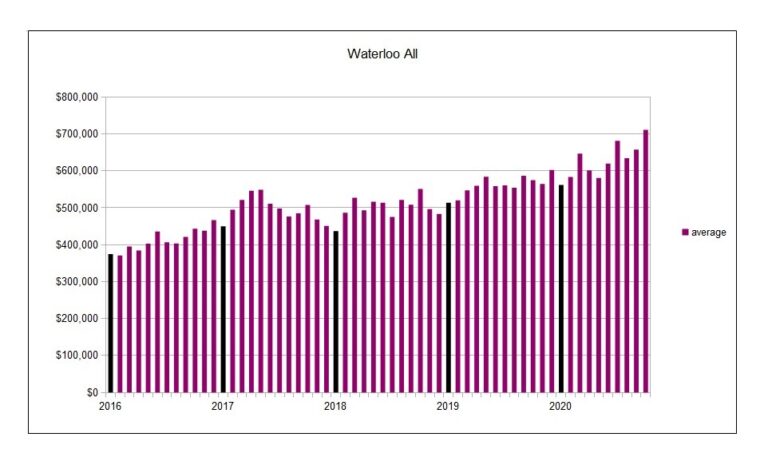

2020 is going to break records for home prices yet again. But this isn’t a one-off, a fluke or an anomaly. And a 5 year look back at home prices really demonstrates just how strong this market has been in the longer term.

This year was hot right from the get-go with prices holding up well through the deep freeze months of January and February.

Then Covid-19 hit. And literally, overnight, everything froze. Sales volumes fell off a cliff and it seemed like prices were sure to follow.

But the pause (and the drop in prices) was very short lived, and prices in Waterloo Region and Guelph are now at historic levels with month over month gains set to eclipse records last set in 2016.

2020 saw bidding wars not unlike ’16 and early ’17, despite a global pandemic causing mass layoffs and shuttered businesses. How is this even possible?

Interest rates, low inventories and subsidies from various levels of government are probably the three biggest factors I can think of keeping buying pressure high in the middle of a pandemic. Fear of missing out and immigration to the region are driving demand as well. Aside from covid subsidies this year these factors have been key to the run up in prices we’ve seen in the last half decade.

That being said if you’ve bought over the last 5 or 6 years you’ve done very well. The only real pause we’ve seen was in the immediate aftermath of the Wynne foreign buyers tax in the spring of 2017.

Prices have nearly doubled in Cambridge and Waterloo (with Kitchener and Guelph not far behind) since the start of 2016. The 5 year look at home prices is evidence that housing has been the best performing asset class for the last 5 years if not the entire decade.