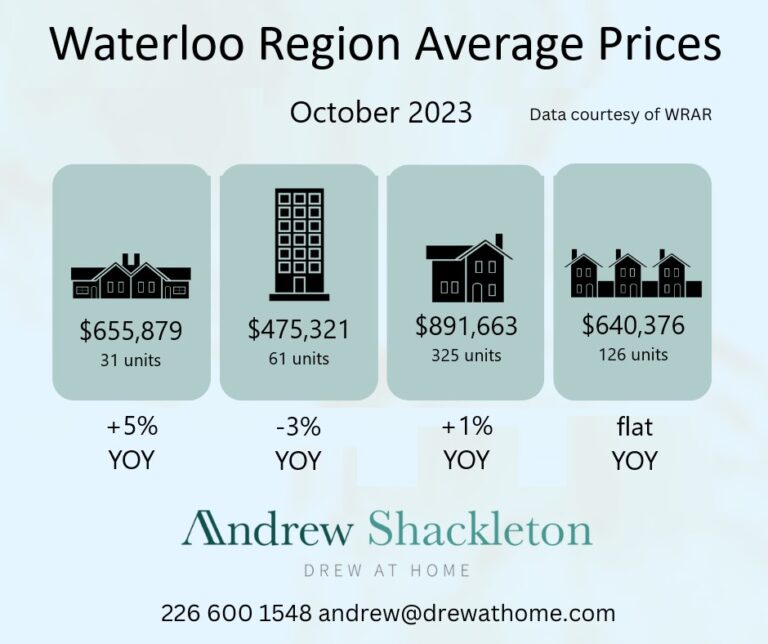

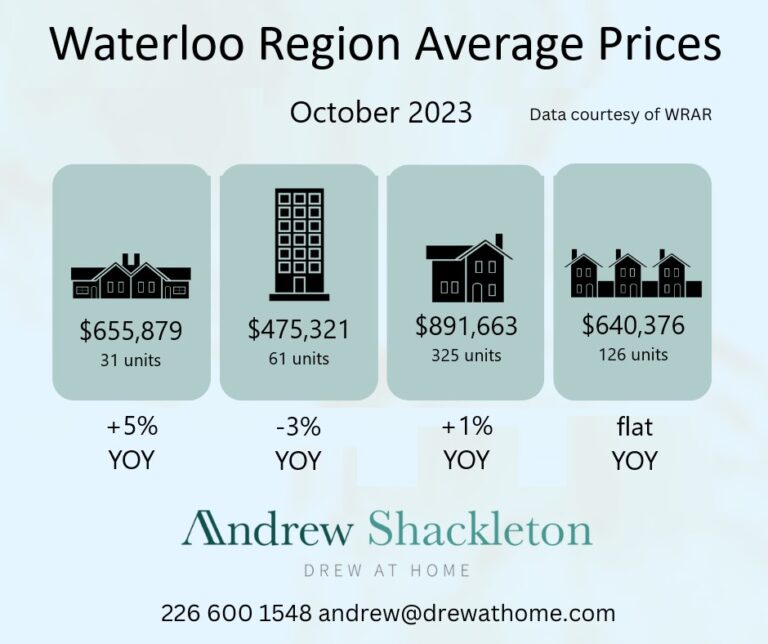

Waterloo Region October 2023 Home Prices

Home prices were mostly flat across Waterloo Region this October. Valuations overall came in close to last year’s figures with sales volumes up 10% on

Home prices were mostly flat across Waterloo Region this October. Valuations overall came in close to last year’s figures with sales volumes up 10% on

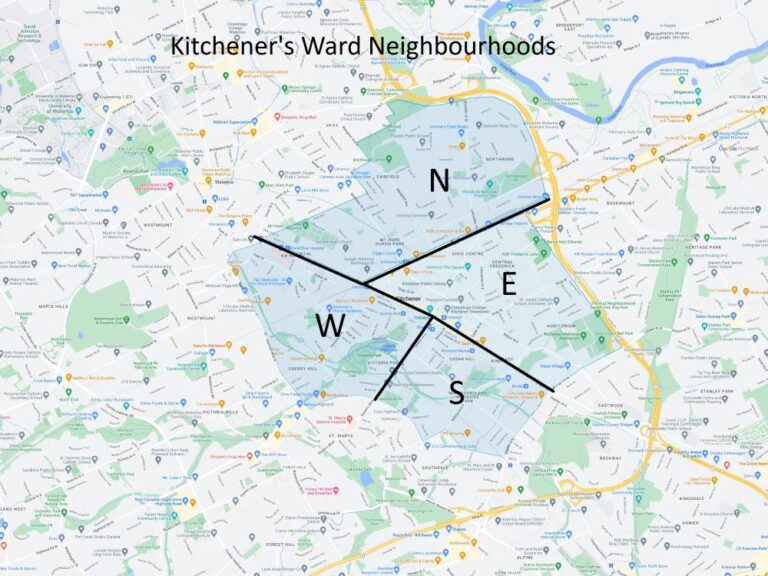

What are Kitchener’s ward neighbourhoods? There are quite a few of them, located in four wards named north, south, east and west. These wards are

This summer’s slowdown in housing market activity continued into September here in Waterloo Region. There were 527 properties sold last month, a figure very close

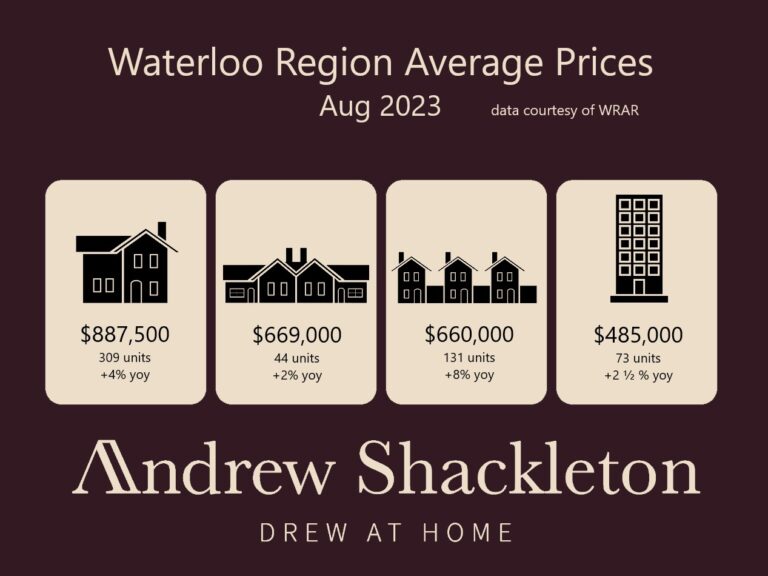

Here in Waterloo Region the tepid housing market we saw in July continued into August as I’d predicted in my post last month. The summer

I am a DIY kind of guy but there are times when help is a good idea. If a job is large and labour intensive

We need a national housing strategy. Supply and demand are seriously out of balance, with rents at record highs. Immigration and high interest rates brought

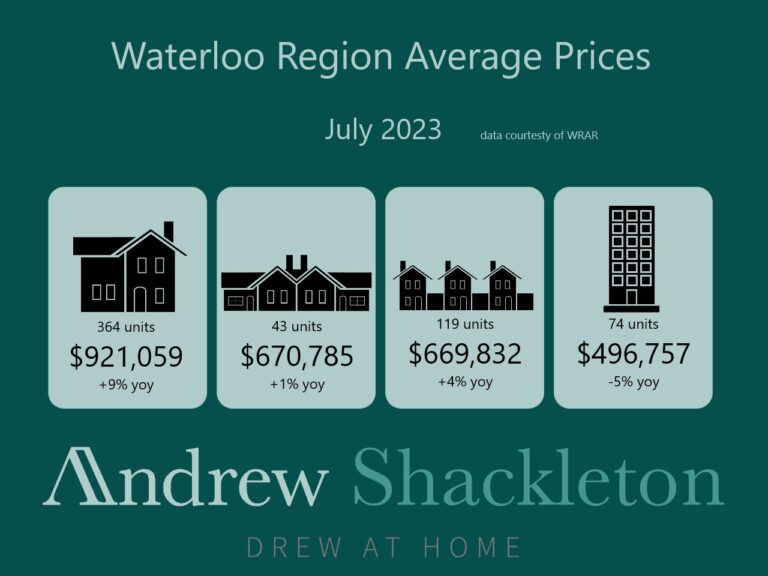

We saw a slowdown in market activity for July 2023, something very typical for the summer months here in Waterloo Region. Sales volumes were down

What happens when your lender’s appraisal comes in low? It’s something that happens from time to time and definitely shoots stress levels off the chart

Parisa and Ali